us japan tax treaty article 17

Because residence is defined so broadly most treaties recognize that a person could meet the definition of residence in more than one jurisdiction ie dual residence and provide a tie. In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses.

Homepage U S Embassy Consulates In Japan

Tax treatyformally known as the Convention between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital Gainsalso addresses.

. VP touts 32 bln investment aimed at stemming Central America migration article with video 901 AM UTC United States US. He Double Tax Avoidance Agreement is a treaty that is signed by two countries. The United States includes citizens and green card holders wherever living as subject to taxation and therefore as residents for tax treaty purposes.

THE MULTILATERAL CONVENTION TO IMPLEMENT TAX TREATY RELATED MEASURES TO PREVENT BASE EROSION AND PROFIT SHIFTING. Subject to the provisions of. Wang criticized Wednesday May 18 2022 what he called.

Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK applicable to payments made on and after January 1 2015 PDF428KB Form 17 - France PDF421KB Form 17 - Australia PDF395KB Form 17 - Kingdom of the Netherlands PDF521KB. Federal Income Tax imposed by the. FILE - Chinese Foreign Minister Wang Yi speaks during a promotional event at the Ministry of Foreign Affairs in Beijing Oct.

The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues. On or after January 1 of the year following the year in which the treaty enters into force. Article 17 Pension in the US Tax Treaty with Japan.

Article 28 also. The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change UNFCCC that commits state parties to reduce greenhouse gas emissions based on the scientific consensus that part one global warming is occurring and part two that human-made CO 2 emissions are driving it. The United States and Japan Tax Treaty Article Six VI refers to income generated from real property and basically provides that if a Resident of one of the states generates income from the other state then that other state may be able to tax the income.

If the Treaty Article Citation includes a P that refers to a protocol that amends the treaty article. 165 Records Page 1 of 17 ADEN Rules 1953. THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND JAPAN FOR THE AVOIDANCE.

For Japan dividends received from a more-than-50-percent-owned corporate subsidiary are exempt if certain conditions. The Income Tax Department NEVER asks for your PIN numbers. May 17 2021 - 030207 PM.

Summary of US tax treaty benefits. These WHTs are commonly referred to using the relevant article of the Income Tax Pajak Penghasilan or PPh Law as follows. Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to.

Attachment for Limitation on Benefits Article. See also Table 3 List of Tax Treaties. Taxpayer in the United States under the Business Profits article of the treaty.

From tax by the other state. A reference to 2P or 5P would be. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8.

Articles 17 and 18 provide that under certain circumstances an individual who is a resident of one state shall be. The agreement is signed to make a country an attractive destination as well as to enable NRIs to take relief from having to pay taxes multiple times.

International Corporate Tax Reform Dgap

A U S Japan Dual Citizen Arrangement Can Benefit Both Countries Tokyo Review

Japan United States International Income Tax Treaty Explained

Japan United States International Income Tax Treaty Explained

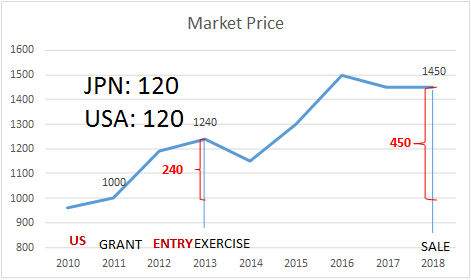

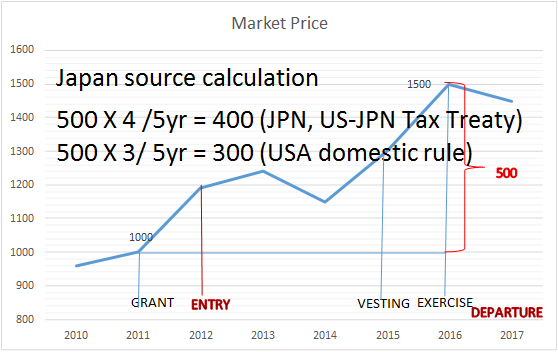

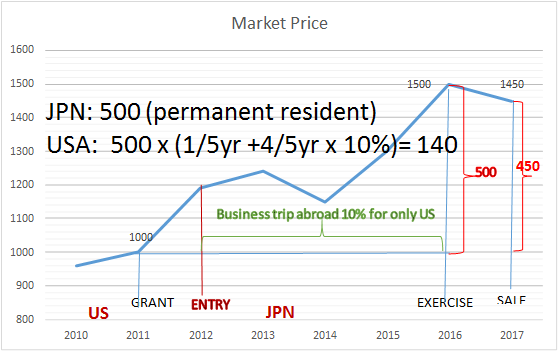

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

A U S Japan Dual Citizen Arrangement Can Benefit Both Countries Tokyo Review

The Shadow Of 1914 Falls Over The Pacific Financial Times

Why Did Japan Sign The Treaty Of Lausanne And The Us Didn T Quora

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Us Stocks Too Expensive Consider Japan Financial Times

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Us Expat Taxes For Americans Living In Japan Bright Tax

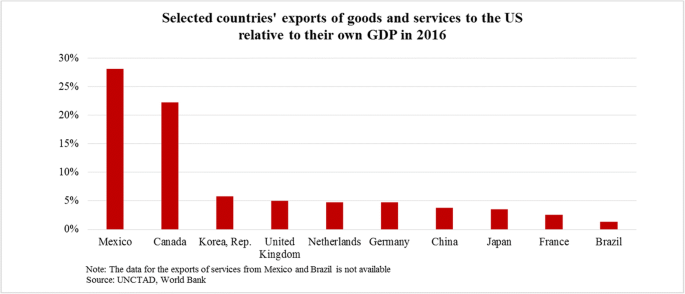

Trump S Trade Policy Brexit Corona Dynamics Eu Crisis And Declining Multilateralism Springerlink

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Us Ch Pension Plans And Treaty Benefits Kpmg Global